The U.S. economic recovery post-COVID-19 has been markedly different from other G10 nations, raising questions about how U.S. inflation compares internationally. This article analyzes key economic indicators, including GDP growth, consumption, employment, and investment, to understand the unique nature of the U.S. recovery and its inflationary experience compared to its global peers.

A Unique Recovery Trajectory

Unlike many G10 countries, the U.S. avoided significant economic scarring after the pandemic. This success stems from robust fiscal support, rapid vaccine deployment, and inherent economic resilience. While other nations opted for premature fiscal consolidation, the U.S. maintained generous countercyclical support, leading to a faster recovery and a tighter labor market.

Source: Haver Analytics

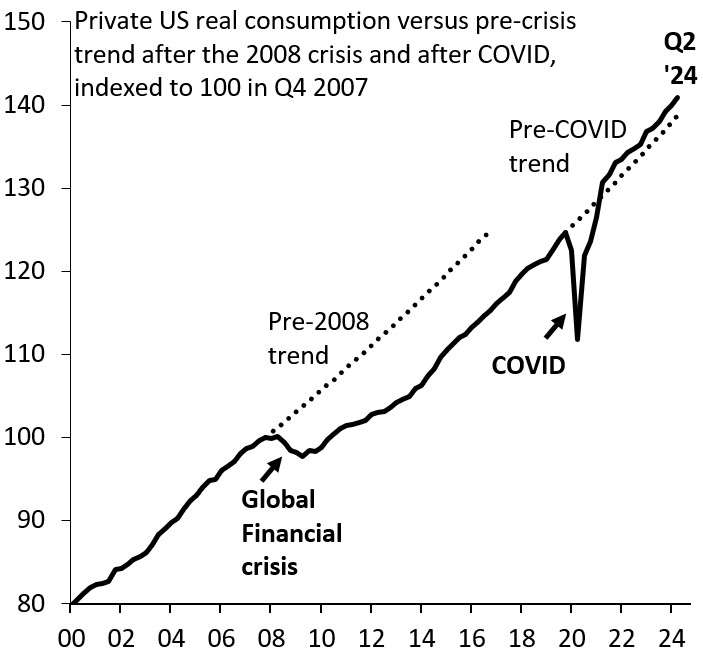

Consumption and Output Gap

A key differentiator has been the absence of a substantial output gap in the U.S. Aggressive fiscal stimulus helped preserve economic activity at pre-recession levels, unlike the post-2008 period. This is reflected in higher private consumption growth compared to other G10 nations.

Source: Haver Analytics

Labor Market Strength

The U.S. labor market experienced a robust rebound, with prime-age labor force participation reaching or exceeding pre-pandemic levels. This contrasts sharply with the sluggish recovery after the 2008 financial crisis. Notably, female labor force participation has reached historic highs.

Source: Haver Analytics

Source: Haver Analytics

Although initially slower, the U.S. labor force participation rebound ultimately surpassed G10 peers.

Source: Haver Analytics

Inflationary Pressures: A Two-Phased Story

U.S. inflation post-pandemic unfolded in two phases. The initial phase was driven by global supply chain disruptions. The second phase saw inflation primarily fueled by rising shelter costs due to housing supply constraints and high mortgage rates.

Source: Haver Analytics

While initial U.S. inflation exceeded G10 levels, it subsequently fell and became comparable to other developed economies, except for Japan.

Source: Haver Analytics

Investment Boom in the U.S.

The U.S. witnessed a significant investment surge, fueled by initiatives like the Inflation Reduction Act and the CHIPS and Science Act. This contrasts with weaker investment trends in other G10 economies, particularly the Eurozone.

Source: Haver Analytics

Conclusion

The U.S. chose to prioritize aggressive fiscal stimulus to mitigate economic scarring, accepting the risk of higher initial inflation. This strategy resulted in stronger growth, a tighter labor market, and an investment boom compared to other G10 nations that opted for more cautious approaches. While U.S. inflation initially outpaced other countries, it eventually converged with global trends, demonstrating a unique trade-off between growth and inflation in the post-pandemic recovery.