Comparing companies within the same industry is a crucial step for investors, analysts, and business professionals aiming to make informed decisions. It provides valuable insights into their relative performance, financial health, and future potential. COMPARE.EDU.VN offers comprehensive comparison tools, enabling you to analyze key metrics and make data-driven decisions. Discover the secrets to industry comparison and identify market leaders, evaluate investment opportunities, and benchmark business strategies.

1. Understanding the Importance of Industry-Specific Comparisons

When assessing a company’s performance, it’s essential to benchmark it against its direct competitors. Comparing companies in the same industry allows for a more relevant and accurate analysis. This is because businesses within the same sector face similar market conditions, regulatory environments, and economic challenges.

1.1. Relevance in Peer Group Analysis

Peer group analysis involves comparing a company’s performance against its competitors. This helps identify best practices, competitive advantages, and areas for improvement. By focusing on industry-specific metrics, investors and analysts can gain a deeper understanding of a company’s strengths and weaknesses relative to its peers.

1.2. Accounting for Industry-Specific Factors

Different industries have unique accounting practices, financial structures, and key performance indicators (KPIs). Comparing companies within the same industry helps control for these factors, providing a more accurate and meaningful comparison. For example, inventory turnover is critical in the retail industry but less relevant in the software sector.

2. Key Financial Ratios for Industry Comparison

Financial ratios are powerful tools for evaluating a company’s financial health and performance. When comparing companies in the same industry, certain ratios are particularly relevant.

2.1. Profitability Ratios

Profitability ratios measure a company’s ability to generate earnings relative to its revenue, assets, or equity. These ratios are essential for assessing how efficiently a company manages its operations and generates profits.

2.1.1. Gross Profit Margin

The gross profit margin indicates the percentage of revenue remaining after deducting the cost of goods sold (COGS). It measures a company’s efficiency in managing production costs.

Formula: Gross Profit Margin = (Revenue – COGS) / Revenue

Example:

| Company | Revenue (Millions) | COGS (Millions) | Gross Profit Margin |

|—|—|—|—|

| Company A | $500 | $300 | 40% |

| Company B | $600 | $330 | 45% |

Analysis: Company B has a higher gross profit margin, indicating better cost management or pricing strategies.

2.1.2. Operating Profit Margin

The operating profit margin reflects a company’s profitability from its core operations before interest and taxes. It measures how well a company controls its operating expenses.

Formula: Operating Profit Margin = Operating Income / Revenue

Example:

| Company | Revenue (Millions) | Operating Income (Millions) | Operating Profit Margin |

|—|—|—|—|

| Company A | $500 | $100 | 20% |

| Company B | $600 | $132 | 22% |

Analysis: Company B has a higher operating profit margin, suggesting more efficient operations.

2.1.3. Net Profit Margin

The net profit margin is the percentage of revenue that remains after all expenses, including interest and taxes, have been deducted. It represents the company’s overall profitability.

Formula: Net Profit Margin = Net Income / Revenue

Example:

| Company | Revenue (Millions) | Net Income (Millions) | Net Profit Margin |

|—|—|—|—|

| Company A | $500 | $50 | 10% |

| Company B | $600 | $66 | 11% |

Analysis: Company B has a slightly higher net profit margin, indicating better overall profitability.

2.2. Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. These ratios are crucial for assessing a company’s financial stability and solvency.

2.2.1. Current Ratio

The current ratio compares a company’s current assets to its current liabilities. It indicates whether a company has enough short-term assets to cover its short-term debts.

Formula: Current Ratio = Current Assets / Current Liabilities

Example:

| Company | Current Assets (Millions) | Current Liabilities (Millions) | Current Ratio |

|—|—|—|—|

| Company A | $200 | $100 | 2.0 |

| Company B | $250 | $150 | 1.67 |

Analysis: Company A has a higher current ratio, indicating stronger short-term liquidity.

2.2.2. Quick Ratio (Acid-Test Ratio)

The quick ratio is a more conservative measure of liquidity that excludes inventory from current assets. It assesses a company’s ability to meet its short-term obligations with its most liquid assets.

Formula: Quick Ratio = (Current Assets – Inventory) / Current Liabilities

Example:

| Company | Current Assets (Millions) | Inventory (Millions) | Current Liabilities (Millions) | Quick Ratio |

|—|—|—|—|—|

| Company A | $200 | $50 | $100 | 1.5 |

| Company B | $250 | $80 | $150 | 1.13 |

Analysis: Company A has a higher quick ratio, indicating better immediate liquidity.

2.3. Solvency Ratios

Solvency ratios measure a company’s ability to meet its long-term obligations. These ratios are essential for assessing a company’s financial stability and risk.

2.3.1. Debt-to-Equity Ratio

The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity. It indicates the extent to which a company is financed by debt versus equity.

Formula: Debt-to-Equity Ratio = Total Debt / Shareholders’ Equity

Example:

| Company | Total Debt (Millions) | Shareholders’ Equity (Millions) | Debt-to-Equity Ratio |

|—|—|—|—|

| Company A | $300 | $500 | 0.6 |

| Company B | $400 | $400 | 1.0 |

Analysis: Company A has a lower debt-to-equity ratio, indicating less reliance on debt financing.

2.3.2. Debt-to-Asset Ratio

The debt-to-asset ratio compares a company’s total debt to its total assets. It indicates the proportion of a company’s assets that are financed by debt.

Formula: Debt-to-Asset Ratio = Total Debt / Total Assets

Example:

| Company | Total Debt (Millions) | Total Assets (Millions) | Debt-to-Asset Ratio |

|—|—|—|—|

| Company A | $300 | $800 | 0.375 |

| Company B | $400 | $800 | 0.5 |

Analysis: Company A has a lower debt-to-asset ratio, indicating a more conservative capital structure.

2.4. Efficiency Ratios

Efficiency ratios measure how effectively a company uses its assets and liabilities to generate sales. These ratios are essential for assessing a company’s operational efficiency.

2.4.1. Inventory Turnover Ratio

The inventory turnover ratio measures how many times a company sells and replenishes its inventory during a period. It indicates the efficiency of inventory management.

Formula: Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

Example:

| Company | Cost of Goods Sold (Millions) | Average Inventory (Millions) | Inventory Turnover Ratio |

|—|—|—|—|

| Company A | $300 | $60 | 5.0 |

| Company B | $330 | $55 | 6.0 |

Analysis: Company B has a higher inventory turnover ratio, indicating more efficient inventory management.

2.4.2. Accounts Receivable Turnover Ratio

The accounts receivable turnover ratio measures how quickly a company collects its receivables from customers. It indicates the efficiency of credit and collection policies.

Formula: Accounts Receivable Turnover Ratio = Net Credit Sales / Average Accounts Receivable

Example:

| Company | Net Credit Sales (Millions) | Average Accounts Receivable (Millions) | Accounts Receivable Turnover Ratio |

|—|—|—|—|

| Company A | $400 | $80 | 5.0 |

| Company B | $450 | $75 | 6.0 |

Analysis: Company B has a higher accounts receivable turnover ratio, indicating more efficient collection of receivables.

2.5. Market Ratios

Market ratios measure a company’s market value relative to its earnings, book value, or sales. These ratios are essential for assessing a company’s attractiveness to investors.

2.5.1. Price-to-Earnings (P/E) Ratio

The price-to-earnings ratio compares a company’s stock price to its earnings per share. It indicates how much investors are willing to pay for each dollar of earnings.

Formula: P/E Ratio = Stock Price / Earnings Per Share (EPS)

Example:

| Company | Stock Price | Earnings Per Share | P/E Ratio |

|—|—|—|—|

| Company A | $50 | $5 | 10 |

| Company B | $60 | $6 | 10 |

Analysis: Both companies have the same P/E ratio, indicating similar valuations relative to earnings.

2.5.2. Price-to-Book (P/B) Ratio

The price-to-book ratio compares a company’s stock price to its book value per share. It indicates how much investors are willing to pay for each dollar of book value.

Formula: P/B Ratio = Stock Price / Book Value Per Share

Example:

| Company | Stock Price | Book Value Per Share | P/B Ratio |

|—|—|—|—|

| Company A | $50 | $25 | 2.0 |

| Company B | $60 | $20 | 3.0 |

Analysis: Company B has a higher P/B ratio, indicating a higher valuation relative to book value.

3. Qualitative Factors to Consider

While financial ratios provide valuable insights, it’s crucial to consider qualitative factors that can impact a company’s performance.

3.1. Management Quality

The quality of a company’s management team can significantly impact its strategic decisions, operational efficiency, and overall performance. Evaluating the experience, track record, and leadership style of the management team is essential.

3.2. Brand Reputation

A strong brand reputation can provide a competitive advantage, attract customers, and enhance customer loyalty. Assessing a company’s brand equity and reputation is crucial.

3.3. Competitive Landscape

Understanding the competitive dynamics within the industry is essential. Analyzing the market share, competitive strategies, and barriers to entry can provide insights into a company’s competitive position.

3.4. Regulatory Environment

The regulatory environment can significantly impact a company’s operations and profitability. Understanding the regulations, compliance requirements, and potential regulatory changes is crucial.

3.5. Technological Innovation

Technological innovation can drive growth, improve efficiency, and create new opportunities. Assessing a company’s investment in research and development (R&D) and its ability to adopt new technologies is essential.

4. Steps to Effectively Compare Companies

To effectively compare companies in the same industry, follow these steps:

4.1. Define the Scope of the Comparison

Determine the purpose of the comparison and the specific questions you want to answer. Define the period of analysis and the geographic scope.

4.2. Identify Comparable Companies

Select companies that operate in the same industry, offer similar products or services, and have comparable business models. Consider factors such as market capitalization, revenue size, and geographic presence.

4.3. Gather Financial Data

Collect financial statements, annual reports, and other relevant financial data for the selected companies. Ensure that the data is accurate, reliable, and consistent.

4.4. Calculate Key Financial Ratios

Calculate the key financial ratios discussed earlier, such as profitability ratios, liquidity ratios, solvency ratios, efficiency ratios, and market ratios.

4.5. Analyze and Interpret the Results

Compare the financial ratios and qualitative factors for the selected companies. Identify strengths, weaknesses, opportunities, and threats (SWOT analysis) for each company.

4.6. Draw Conclusions and Make Recommendations

Based on the analysis, draw conclusions about the relative performance and financial health of the selected companies. Make recommendations for investment decisions, business strategies, or operational improvements.

5. Tools and Resources for Company Comparison

Several tools and resources can assist in comparing companies in the same industry:

5.1. Financial Databases

Financial databases such as Bloomberg, Thomson Reuters, and FactSet provide comprehensive financial data, ratios, and analysis tools.

5.2. Company Websites

Company websites offer access to annual reports, financial statements, investor presentations, and other relevant information.

5.3. Industry Reports

Industry reports from research firms such as McKinsey, Deloitte, and PwC provide insights into industry trends, competitive landscapes, and key performance indicators.

5.4. SEC Filings

The U.S. Securities and Exchange Commission (SEC) EDGAR database provides access to company filings, including 10-K annual reports and 10-Q quarterly reports.

5.5. COMPARE.EDU.VN

COMPARE.EDU.VN offers comparison tools that allow users to compare financial metrics, qualitative factors, and other relevant data for companies in the same industry.

6. Common Pitfalls to Avoid

When comparing companies, avoid these common pitfalls:

6.1. Comparing Apples to Oranges

Ensure that you are comparing companies that are truly comparable in terms of industry, business model, and size.

6.2. Relying Solely on Financial Ratios

Consider qualitative factors such as management quality, brand reputation, and competitive landscape.

6.3. Ignoring Industry-Specific Factors

Account for industry-specific accounting practices, financial structures, and key performance indicators.

6.4. Focusing on Short-Term Results

Consider long-term trends and sustainable competitive advantages.

6.5. Overlooking Data Quality

Ensure that the financial data is accurate, reliable, and consistent.

7. Real-World Examples of Company Comparison

Let’s look at some real-world examples of comparing companies in different industries.

7.1. Comparing Apple and Samsung (Technology Industry)

Apple and Samsung are two leading companies in the technology industry. Comparing their financial ratios and qualitative factors can provide insights into their relative performance and competitive positions.

| Metric | Apple | Samsung |

|---|---|---|

| Revenue (Billions) | $365.8 | $200.7 |

| Net Profit Margin | 25.9% | 10.8% |

| R&D Spending (Billions) | $21.9 | $17.7 |

| Brand Value (Billions) | $408.3 | $87.7 |

Analysis: Apple has higher revenue, net profit margin, and brand value, indicating stronger overall performance. Samsung has significant R&D spending, indicating a focus on innovation.

7.2. Comparing McDonald’s and Burger King (Restaurant Industry)

McDonald’s and Burger King are two major players in the restaurant industry. Comparing their financial ratios and qualitative factors can provide insights into their relative performance and competitive positions.

| Metric | McDonald’s | Burger King |

|---|---|---|

| Revenue (Billions) | $23.2 | $1.6 |

| Net Profit Margin | 19.2% | 8.5% |

| Number of Restaurants | 39,198 | 18,838 |

| Customer Satisfaction | 78 | 75 |

Analysis: McDonald’s has higher revenue, net profit margin, and number of restaurants, indicating stronger overall performance. Both companies have comparable customer satisfaction scores.

7.3. Comparing Coca-Cola and PepsiCo (Beverage Industry)

Coca-Cola and PepsiCo are two dominant companies in the beverage industry. Comparing their financial ratios and qualitative factors can provide insights into their relative performance and competitive positions.

| Metric | Coca-Cola | PepsiCo |

|---|---|---|

| Revenue (Billions) | $41.9 | $79.4 |

| Net Profit Margin | 22.4% | 11.1% |

| Brand Value (Billions) | $87.6 | $26.4 |

| Market Share | 43% | 24% |

Analysis: PepsiCo has higher revenue due to its diversified portfolio, while Coca-Cola has a higher net profit margin and brand value. Coca-Cola also has a larger market share in the beverage industry.

8. The Role of Technology in Simplifying Company Comparisons

Technology plays a vital role in simplifying company comparisons, providing access to data, analysis tools, and visualization capabilities.

8.1. Data Aggregation and Analysis

Technology enables the aggregation of financial data from various sources, automating the calculation of key financial ratios and providing real-time analysis.

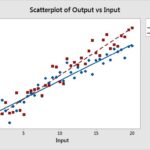

8.2. Visualization and Reporting

Visualization tools such as charts, graphs, and dashboards can help present complex financial data in a clear and understandable format. Reporting tools can automate the creation of reports and presentations.

8.3. Predictive Analytics

Predictive analytics tools can help forecast future financial performance based on historical data and industry trends.

8.4. AI and Machine Learning

Artificial intelligence (AI) and machine learning (ML) can automate the identification of comparable companies, analyze qualitative factors, and provide insights into competitive dynamics.

8.5. Online Comparison Platforms

Online comparison platforms such as COMPARE.EDU.VN provide access to comparison tools, financial data, and analysis capabilities.

9. Expert Insights and Best Practices

Here are some expert insights and best practices for comparing companies in the same industry:

9.1. Consult with Industry Experts

Seek advice from industry experts, analysts, and consultants who have deep knowledge of the industry and the companies you are comparing.

9.2. Attend Industry Conferences and Events

Attend industry conferences and events to network with industry professionals, learn about industry trends, and gather insights.

9.3. Read Industry Publications and Blogs

Stay informed about industry developments by reading industry publications, blogs, and newsletters.

9.4. Join Industry Associations

Join industry associations to access research reports, networking opportunities, and educational resources.

9.5. Use a Balanced Scorecard Approach

Use a balanced scorecard approach to assess companies from multiple perspectives, including financial, customer, internal processes, and learning and growth.

10. Frequently Asked Questions (FAQs)

1. What is ratio analysis?

Ratio analysis is a method of analyzing a company’s financial statements to evaluate its performance and financial health.

2. Why is it important to compare companies in the same industry?

Comparing companies in the same industry allows for a more relevant and accurate analysis, as they face similar market conditions and economic challenges.

3. What are the key financial ratios for industry comparison?

Key financial ratios include profitability ratios, liquidity ratios, solvency ratios, efficiency ratios, and market ratios.

4. What qualitative factors should be considered when comparing companies?

Qualitative factors include management quality, brand reputation, competitive landscape, regulatory environment, and technological innovation.

5. What are some common pitfalls to avoid when comparing companies?

Common pitfalls include comparing apples to oranges, relying solely on financial ratios, ignoring industry-specific factors, focusing on short-term results, and overlooking data quality.

6. What tools and resources can assist in comparing companies?

Tools and resources include financial databases, company websites, industry reports, SEC filings, and online comparison platforms.

7. How can technology simplify company comparisons?

Technology can simplify company comparisons through data aggregation and analysis, visualization and reporting, predictive analytics, AI and machine learning, and online comparison platforms.

8. What is the price-to-earnings (P/E) ratio?

The P/E ratio compares a company’s stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings.

9. What is the debt-to-equity ratio?

The debt-to-equity ratio compares a company’s total debt to its shareholders’ equity, indicating the extent to which a company is financed by debt versus equity.

10. Where can I find reliable financial data for companies?

You can find reliable financial data for companies in financial databases, company websites, industry reports, and SEC filings.

Conclusion: Empowering Informed Decisions with COMPARE.EDU.VN

Comparing companies in the same industry is a critical process for investors, analysts, and business professionals. By analyzing key financial ratios, considering qualitative factors, and leveraging technology, you can gain valuable insights into their relative performance, financial health, and future potential. COMPARE.EDU.VN is your go-to platform for comprehensive company comparisons. Ready to make informed decisions? Visit COMPARE.EDU.VN today and start comparing companies with ease. Our platform provides detailed financial data, insightful analysis, and user-friendly tools to help you evaluate and compare businesses effectively. Make smarter investment and business choices with COMPARE.EDU.VN.

Address: 333 Comparison Plaza, Choice City, CA 90210, United States

Whatsapp: +1 (626) 555-9090

Website: compare.edu.vn