How Do I Compare Financially? Understanding how your financial situation stacks up against others can provide valuable insights. COMPARE.EDU.VN offers detailed comparisons of various financial metrics to help you assess your financial standing and make informed decisions about your money. Explore different financial comparison tools and data to empower your financial future with comparative analysis, peer benchmarking, and economic evaluation.

1. Why Should I Compare Financially?

Comparing your financial situation to others can be a powerful tool for self-assessment and motivation. It provides a benchmark to understand where you stand relative to your peers, identify areas for improvement, and set realistic financial goals. While it’s essential to avoid direct comparisons that might lead to stress or unhealthy financial behaviors, using financial comparisons wisely can drive positive change and inform better financial decisions.

1.1. Identifying Your Financial Position

Comparing your finances helps you understand where you stand in the broader economic landscape. It’s not about keeping up with the Joneses, but rather about gaining a clear perspective on your financial health.

1.2. Setting Realistic Financial Goals

Benchmarking your finances allows you to set achievable goals. By seeing what others in similar situations have accomplished, you can tailor your financial objectives to be both ambitious and attainable.

1.3. Motivating Financial Discipline

Discovering that you are behind your peers in certain financial aspects can be a powerful motivator. It can spur you to save more, invest smarter, and take your financial planning more seriously.

1.4. Avoiding Unhealthy Comparisons

It’s important to remember that everyone’s financial journey is unique. Comparing your finances should be used as a tool for insight, not as a definitive measure of success.

2. What Financial Metrics Can I Compare?

When you want to compare financially, several key metrics can provide a comprehensive overview of your financial health. These include net worth, income, debt levels, savings rates, and investment returns. Each metric offers a different perspective, and together, they paint a complete picture of your financial standing.

2.1. Net Worth

Net worth is a fundamental measure of your financial health, representing the difference between your assets and liabilities. Comparing your net worth to others in your age group or income bracket can provide valuable insights into your overall financial position.

2.2. Income

Comparing your income to the average or median income of your peers can help you understand if you are earning enough to meet your financial goals. It’s also important to consider your income relative to your cost of living.

2.3. Debt Levels

Assessing your debt levels and comparing them to benchmarks can help you determine if you are carrying too much debt. High debt levels can hinder your ability to save and invest, so it’s essential to keep them in check.

2.4. Savings Rates

Comparing your savings rate to the recommended benchmarks can help you ensure you are saving enough for retirement and other long-term goals. A healthy savings rate is crucial for building financial security.

2.5. Investment Returns

Evaluating your investment returns relative to market averages or the performance of similar investments can help you assess your investment strategy. It’s important to ensure your investments are growing at a rate that will help you achieve your financial goals.

3. How to Calculate Your Net Worth for Financial Comparison

Calculating your net worth is the first step in understanding your financial standing. It involves adding up all your assets, such as cash, investments, and property, and subtracting all your liabilities, such as loans and credit card debt.

3.1. Listing Your Assets

Start by listing all your assets, including:

- Cash: Checking and savings accounts

- Investments: Stocks, bonds, mutual funds, and retirement accounts

- Property: Real estate, vehicles, and valuable personal possessions

3.2. Calculating Your Liabilities

Next, calculate your liabilities, including:

- Loans: Mortgages, student loans, and car loans

- Credit Card Debt: Outstanding balances on your credit cards

- Other Debts: Any other outstanding financial obligations

3.3. Subtracting Liabilities from Assets

Subtract your total liabilities from your total assets to calculate your net worth:

Net Worth = Total Assets - Total Liabilities

3.4. Using Online Tools

Several online tools and calculators can help you calculate your net worth quickly and accurately. These tools often provide a breakdown of your assets and liabilities, making it easier to track your financial progress.

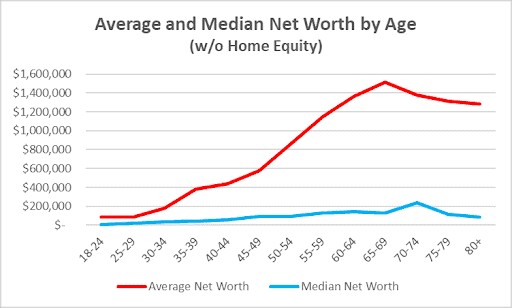

4. What Are the Average Net Worth Figures by Age?

Understanding the average net worth by age can provide a useful benchmark for assessing your financial progress. However, it’s important to remember that these are just averages, and your individual circumstances may vary.

4.1. Net Worth by Age Group

Here’s a general guideline for average net worth by age group:

| Age Group | Average Net Worth |

|---|---|

| 25-34 | $50,000 – $150,000 |

| 35-44 | $150,000 – $400,000 |

| 45-54 | $400,000 – $800,000 |

| 55-64 | $800,000 – $1,500,000 |

| 65+ | $1,500,000+ |

These figures are approximate and can vary based on factors such as income, education, and location.

4.2. Factors Influencing Net Worth

Several factors can influence your net worth, including:

- Income: Higher income generally leads to higher net worth.

- Savings Rate: Saving a larger percentage of your income can significantly increase your net worth over time.

- Investment Returns: Higher investment returns can accelerate the growth of your net worth.

- Debt Levels: Lower debt levels can free up more money for saving and investing.

- Education: Higher education levels often lead to higher earning potential and, consequently, higher net worth.

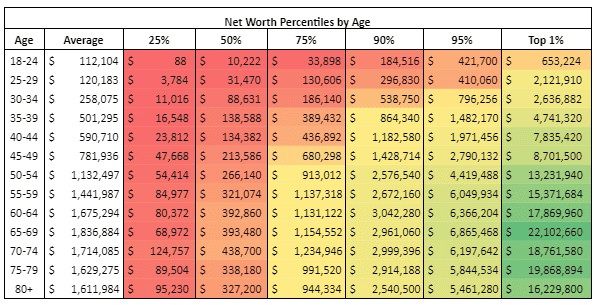

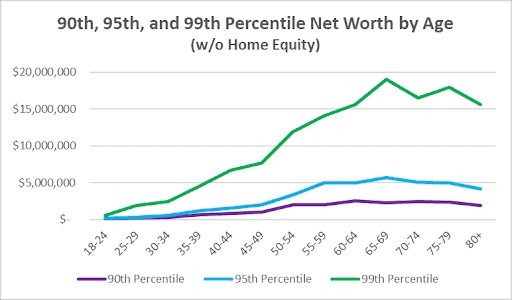

4.3. Using Net Worth Percentiles

Instead of focusing solely on averages, consider using net worth percentiles to compare your financial standing. Percentiles provide a more nuanced view of wealth distribution, showing where you rank relative to others.

4.4. Avoiding Comparison Traps

While it’s useful to compare your net worth to benchmarks, avoid falling into the comparison trap. Focus on your own financial goals and progress, rather than getting caught up in what others have achieved.

5. How Does Income Affect Financial Comparisons?

Income plays a significant role in financial comparisons, as it directly impacts your ability to save, invest, and build wealth. Comparing your income to others in similar professions or locations can provide valuable insights into your earning potential and financial opportunities.

5.1. Average Income by Profession

Different professions have varying income levels. Comparing your income to the average for your profession can help you determine if you are being fairly compensated and identify opportunities for career advancement.

5.2. Income by Location

The cost of living varies significantly by location, so it’s important to consider your income relative to the cost of living in your area. A higher income in an expensive city may not go as far as a lower income in a more affordable area.

5.3. Income and Savings Rates

Your income directly impacts your ability to save. A higher income generally allows for a higher savings rate, which can significantly boost your net worth over time.

5.4. Income and Investment Opportunities

Higher income levels often provide more opportunities for investment. With more disposable income, you can invest in a wider range of assets and potentially achieve higher returns.

5.5. Income and Debt Management

Your income also affects your ability to manage debt. A higher income can make it easier to pay off debt and avoid accumulating new debt, improving your overall financial health.

6. What Role Does Debt Play in Financial Comparisons?

Debt is a critical factor in financial comparisons, as it can significantly impact your net worth and financial stability. High debt levels can hinder your ability to save and invest, while low debt levels can free up more resources for building wealth.

6.1. Types of Debt

Different types of debt have varying impacts on your financial health. Mortgages and student loans are often considered “good” debt because they can lead to long-term benefits, such as homeownership and higher earning potential. Credit card debt and other high-interest debts are generally considered “bad” debt because they can quickly accumulate and become difficult to manage.

6.2. Debt-to-Income Ratio

The debt-to-income (DTI) ratio is a key metric for assessing your debt burden. It represents the percentage of your gross monthly income that goes towards paying off debt. A lower DTI ratio indicates a healthier financial situation.

6.3. Comparing Debt Levels

Comparing your debt levels to benchmarks can help you determine if you are carrying too much debt. Financial experts often recommend keeping your total debt-to-income ratio below 43%.

6.4. Managing Debt Effectively

Effective debt management strategies include:

- Prioritizing High-Interest Debt: Focus on paying off high-interest debt, such as credit card debt, first.

- Creating a Budget: Develop a budget to track your income and expenses and identify areas where you can cut back and allocate more money towards debt repayment.

- Consolidating Debt: Consider consolidating your debt into a single loan with a lower interest rate.

- Seeking Professional Help: If you are struggling to manage your debt, seek help from a financial advisor or credit counselor.

6.5. Debt and Net Worth

High debt levels can significantly reduce your net worth. By reducing your debt, you can increase your net worth and improve your overall financial health.

7. How Do Savings and Investments Factor Into Financial Comparisons?

Savings and investments are essential components of financial comparisons. They represent your ability to build wealth and achieve your long-term financial goals.

7.1. Savings Rate

The savings rate is the percentage of your income that you save each month. A higher savings rate allows you to accumulate wealth more quickly. Financial experts often recommend saving at least 15% of your income for retirement.

7.2. Emergency Fund

An emergency fund is a savings account that is specifically set aside for unexpected expenses, such as medical bills or job loss. It is generally recommended to have three to six months’ worth of living expenses in an emergency fund.

7.3. Investment Portfolio

Your investment portfolio includes all the assets you have invested in, such as stocks, bonds, and mutual funds. The composition of your portfolio should align with your risk tolerance and financial goals.

7.4. Investment Returns

The returns on your investments can significantly impact your ability to build wealth. It’s important to monitor your investment returns and adjust your strategy as needed.

7.5. Diversification

Diversification is a key investment strategy that involves spreading your investments across a variety of asset classes. This can help reduce risk and improve your overall returns.

7.6. Comparing Investment Performance

Comparing your investment performance to market benchmarks or the performance of similar investments can help you assess your investment strategy. If your investments are underperforming, consider making changes to your portfolio.

8. What Are the Key Performance Indicators (KPIs) for Financial Health?

Key Performance Indicators (KPIs) are metrics that provide a snapshot of your financial health. Monitoring these KPIs can help you track your progress and identify areas for improvement.

8.1. Net Worth

Net worth is a primary KPI for financial health. Tracking your net worth over time can help you see if you are making progress towards your financial goals.

8.2. Debt-to-Income Ratio (DTI)

The debt-to-income ratio is another key KPI. Keeping your DTI low can improve your financial stability and free up more resources for saving and investing.

8.3. Savings Rate

Your savings rate is a critical KPI for building wealth. Aim to save at least 15% of your income for retirement.

8.4. Emergency Fund Balance

The balance of your emergency fund is a vital KPI for financial security. Ensure you have three to six months’ worth of living expenses in your emergency fund.

8.5. Credit Score

Your credit score is a KPI that reflects your creditworthiness. A good credit score can help you qualify for lower interest rates on loans and credit cards.

8.6. Investment Returns

The returns on your investments are a key KPI for assessing your investment strategy. Monitor your investment returns and adjust your portfolio as needed.

8.7. Tracking KPIs Over Time

Tracking your KPIs over time can provide valuable insights into your financial progress. Use a spreadsheet or financial management tool to monitor your KPIs and identify trends.

9. How Can I Use Financial Comparison Tools Effectively?

Financial comparison tools can be valuable resources for assessing your financial standing and identifying areas for improvement. However, it’s important to use these tools effectively to get the most accurate and meaningful results.

9.1. Choosing the Right Tools

Select financial comparison tools that are relevant to your specific goals and needs. Whether you’re comparing net worth, income, debt levels, or investment returns, choose tools that provide accurate and reliable data.

9.2. Inputting Accurate Data

Ensure you input accurate and up-to-date data into the financial comparison tools. Inaccurate data can lead to misleading results and incorrect conclusions.

9.3. Understanding the Metrics

Familiarize yourself with the metrics used by the financial comparison tools. Understand what each metric represents and how it is calculated.

9.4. Interpreting the Results

Carefully interpret the results provided by the financial comparison tools. Consider the context of your individual circumstances and avoid drawing hasty conclusions based solely on the data.

9.5. Seeking Professional Advice

If you’re unsure how to interpret the results of financial comparison tools, seek advice from a financial advisor. A professional can help you understand the data and develop a plan to improve your financial health.

10. What Are Common Mistakes to Avoid When Comparing Finances?

When comparing your finances to others, it’s important to avoid common mistakes that can lead to stress, unrealistic expectations, and poor financial decisions.

10.1. Comparing Yourself to Everyone

Avoid comparing yourself to everyone. Focus on comparing your finances to those in similar situations, such as your age group, income bracket, or profession.

10.2. Ignoring Individual Circumstances

Remember that everyone’s financial journey is unique. Don’t ignore your individual circumstances, such as your education, career path, and life events.

10.3. Chasing Unrealistic Goals

Avoid chasing unrealistic financial goals based on what others have achieved. Set goals that are ambitious but attainable, given your individual circumstances.

10.4. Neglecting Long-Term Planning

Don’t neglect long-term financial planning in favor of short-term comparisons. Focus on building a solid financial foundation for the future.

10.5. Overlooking Non-Financial Factors

Remember that financial success is not the only measure of a fulfilling life. Don’t overlook non-financial factors, such as your health, relationships, and personal satisfaction.

11. How to Improve Your Financial Standing After Comparison?

After comparing your finances and identifying areas for improvement, take action to improve your financial standing. Develop a plan, set goals, and implement strategies to build wealth and achieve financial security.

11.1. Setting Financial Goals

Set clear, specific, and measurable financial goals. Whether you want to increase your net worth, reduce your debt, or save more for retirement, having clear goals can help you stay motivated and on track.

11.2. Creating a Budget

Develop a budget to track your income and expenses and identify areas where you can cut back and save more money.

11.3. Reducing Debt

Implement strategies to reduce your debt, such as prioritizing high-interest debt, consolidating debt, or seeking help from a financial advisor.

11.4. Increasing Savings

Increase your savings rate by cutting expenses, increasing your income, or automating your savings.

11.5. Investing Wisely

Develop a diversified investment portfolio that aligns with your risk tolerance and financial goals. Monitor your investment returns and adjust your strategy as needed.

11.6. Seeking Professional Advice

Consider seeking advice from a financial advisor who can provide personalized guidance and help you develop a comprehensive financial plan.

12. What Are the Benefits of Consulting a Financial Advisor?

Consulting a financial advisor can provide numerous benefits, especially when you are trying to understand and improve your financial standing.

12.1. Personalized Advice

A financial advisor can provide personalized advice tailored to your individual circumstances, goals, and risk tolerance.

12.2. Comprehensive Financial Planning

A financial advisor can help you develop a comprehensive financial plan that addresses all aspects of your financial life, including budgeting, debt management, saving, investing, and retirement planning.

12.3. Expert Guidance

A financial advisor can provide expert guidance on complex financial topics, such as investment strategies, tax planning, and estate planning.

12.4. Objective Perspective

A financial advisor can offer an objective perspective on your financial situation, helping you make informed decisions without being influenced by emotions or biases.

12.5. Accountability

A financial advisor can provide accountability, helping you stay on track with your financial goals and make progress towards financial security.

12.6. Time Savings

A financial advisor can save you time by handling the complexities of financial planning and investment management, allowing you to focus on other priorities.

13. How Does Home Equity Affect Financial Comparison?

Home equity, the difference between the value of your home and the amount you owe on your mortgage, can significantly affect financial comparisons. It is a major component of net worth for many individuals, but it’s important to understand how it impacts your overall financial picture.

13.1. Including Home Equity in Net Worth

When calculating your net worth, home equity is included as an asset. This can significantly increase your net worth, especially if you have a substantial amount of equity in your home.

13.2. Excluding Home Equity for Investable Assets

For a more accurate assessment of your investable assets, you may want to exclude home equity from your net worth calculation. This provides a clearer picture of the funds available for investments and retirement savings.

13.3. Home Equity and Debt

While home equity is an asset, it’s important to consider the debt associated with your mortgage. A large mortgage can offset the benefits of home equity and reduce your overall financial flexibility.

13.4. Using Home Equity Wisely

Consider using home equity for strategic purposes, such as home improvements or debt consolidation, rather than for discretionary spending.

13.5. Home Equity and Retirement

Home equity can be a valuable asset in retirement, either through downsizing, reverse mortgages, or other strategies. Consult with a financial advisor to determine the best way to leverage your home equity in retirement.

14. What Are the Limitations of Financial Comparisons?

While financial comparisons can be useful, it’s important to recognize their limitations and avoid drawing inaccurate conclusions.

14.1. Incomplete Information

Financial comparisons often rely on averages and benchmarks, which may not reflect the full picture of your individual circumstances.

14.2. Lack of Context

Financial comparisons may not take into account the context of your financial decisions, such as your career path, education, and life events.

14.3. Emotional Impact

Financial comparisons can have a negative emotional impact, leading to stress, anxiety, and unhealthy financial behaviors.

14.4. Outdated Data

Financial comparisons may rely on outdated data, which may not accurately reflect the current economic climate.

14.5. Focus on Quantity, Not Quality

Financial comparisons often focus on quantitative metrics, such as net worth and income, rather than qualitative factors, such as financial security and peace of mind.

14.6. Risk of Conformity

Financial comparisons can lead to a desire to conform to societal norms, which may not align with your individual goals and values.

15. How Can COMPARE.EDU.VN Help Me Compare Financially?

COMPARE.EDU.VN provides a wealth of resources and tools to help you compare financially and make informed decisions about your money. Our platform offers detailed comparisons of various financial metrics, as well as expert insights and guidance to help you improve your financial standing.

15.1. Detailed Financial Comparisons

COMPARE.EDU.VN offers detailed comparisons of net worth, income, debt levels, savings rates, and investment returns, allowing you to see how you stack up against your peers.

15.2. Expert Insights and Guidance

Our platform provides expert insights and guidance on various financial topics, helping you understand the data and develop a plan to improve your financial health.

15.3. Financial Planning Tools

COMPARE.EDU.VN offers a range of financial planning tools, such as budget calculators, debt repayment calculators, and investment portfolio analyzers, to help you manage your finances effectively.

15.4. Access to Financial Advisors

Our platform connects you with qualified financial advisors who can provide personalized guidance and help you achieve your financial goals.

15.5. Educational Resources

COMPARE.EDU.VN offers a wealth of educational resources, including articles, guides, and videos, to help you learn about financial planning and make informed decisions.

15.6. Community Support

Our platform provides a community forum where you can connect with other users, share your experiences, and get advice from your peers.

FAQ: Comparing Finances

FAQ 1: Is it healthy to compare my finances with others?

Comparing your finances can be helpful if used as a tool for self-assessment and motivation, but avoid direct comparisons that might lead to stress.

FAQ 2: What financial metrics should I compare?

Key metrics include net worth, income, debt levels, savings rates, and investment returns.

FAQ 3: How do I calculate my net worth?

Subtract your total liabilities from your total assets to calculate your net worth.

FAQ 4: What is a good debt-to-income ratio?

Financial experts often recommend keeping your total debt-to-income ratio below 43%.

FAQ 5: How much should I save for retirement?

Aim to save at least 15% of your income for retirement.

FAQ 6: What is an emergency fund?

An emergency fund is a savings account set aside for unexpected expenses, typically three to six months’ worth of living expenses.

FAQ 7: How does home equity affect financial comparisons?

Home equity can significantly increase your net worth, but it’s important to consider the debt associated with your mortgage.

FAQ 8: What are the limitations of financial comparisons?

Limitations include incomplete information, lack of context, and the potential for negative emotional impact.

FAQ 9: Can a financial advisor help me compare financially?

Yes, a financial advisor can provide personalized guidance and help you develop a comprehensive financial plan.

FAQ 10: Where can I find reliable financial comparison tools?

COMPARE.EDU.VN offers detailed comparisons and resources to help you assess your financial standing and make informed decisions.

Conclusion: Take Control of Your Financial Future

Comparing your finances can be a powerful tool for understanding your financial standing, setting realistic goals, and motivating positive change. By using financial comparison tools effectively, avoiding common mistakes, and seeking advice from a financial advisor, you can take control of your financial future and achieve financial security. Visit COMPARE.EDU.VN today to explore our resources and start comparing your finances with confidence. Remember, the journey to financial well-being is a personal one, and COMPARE.EDU.VN is here to support you every step of the way with wealth assessment, income benchmarking, and fiscal analysis.

Ready to take the next step in understanding your financial health? Visit COMPARE.EDU.VN today and discover the resources and tools you need to compare your finances effectively. Our detailed comparisons, expert insights, and personalized guidance will help you make informed decisions and achieve your financial goals. Contact us at 333 Comparison Plaza, Choice City, CA 90210, United States, or reach out via Whatsapp at +1 (626) 555-9090. Start your journey to financial well-being with compare.edu.vn today.